Progress at last in Family Farm Tax campaign

Helen Morgan MP has welcomed news that inheritance tax relief thresholds for farmers will be increased - but called on the Government to cut the unfair Family Farm Tax in full.

The Government announced on Tuesday that the level of the Agricultural and Business Property Reliefs threshold will be increased from £1m to £2.5m when it is introduced in April 2026.

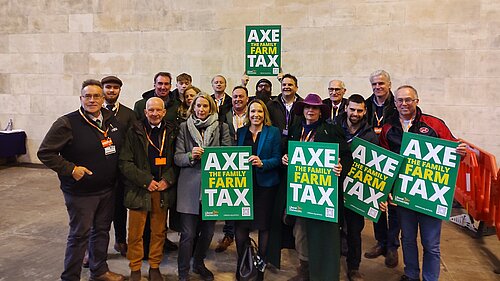

This comes after a prolonged campaign by farmers, supported by the Liberal Democrats, to oppose changes announced by Rachel Reeves at the Budget in 2024.

The changes were announced just one week after Helen and colleagues voted against the Family Farm Tax in Parliament.

Reacting to the news, Helen Morgan, MP for North Shropshire, said:

“This change is a hard-won improvement on the Government’s original family farm tax which should never have been threatened in the first place.

“I’ve been proud to stand alongside the farmers who have campaigned so tirelessly to achieve this – now the Government must go further and scrap this unfair tax in full.

“Shropshire’s economy and the nation’s food security depends on hardworking family farmers, many of whom are already struggling to make a living.

“The Government should be backing British farmers, not pushing them out of business with short-sighted tax raids.”